News Release Connect with DOL at https://blog.dol.gov TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL 8:30 A.M. (Eastern) Thursday, April 18, 2024 UNEMPLOYMENT INSURANCE WEEKLY CLAIMS SEASONALLY ADJUSTED DATA In the week ending April 13, the advance figure for seasonally adjusted initial claims was 212,000, unchanged from the previous week's revised level. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 214,500, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 214,250 to 214,500. The advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending April 6, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending April 6 was 1,812,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised down by 7,000 from 1,817,000 to 1,810,000. The 4-week moving average was 1,805,250, an increase of 4,250 from the previous week's revised average. The previous week's average was revised down by 1,750 from 1,802,750 to 1,801,000. 1 UNADJUSTED DATA The advance number of actual initial claims under state programs, unadjusted, totaled 208,509 in the week ending April 13, a decrease of 6,756 (or -3.1 percent) from the previous week. The seasonal factors had expected a decrease of 6,369 (or -3.0 percent) from the previous week. There were 216,740 initial claims in the comparable week in 2023. The advance unadjusted insured unemployment rate was 1.2 percent during the week ending April 6, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,864,123, a decrease of 63,886 (or -3.3 percent) from the preceding week. The seasonal factors had expected a decrease of 65,172 (or -3.4 percent) from the previous week. A year earlier the rate was 1.2 percent and the volume was 1,785,781. The total number of continued weeks claimed for benefits in all programs for the week ending March 30 was 1,953,031, a decrease of 12,519 from the previous week. There were 1,821,910 weekly claims filed for benefits in all programs in the comparable week in 2023. No state was triggered "on" the Extended Benefits program during the week ending March 30. Initial claims for UI benefits filed by former Federal civilian employees totaled 327 in the week ending April 6, an increase of 5 from the prior week. There were 435 initial claims filed by newly discharged veterans, an increase of 66 from the preceding week. There were 5,546 continued weeks claimed filed by former Federal civilian employees the week ending March 30, a decrease of 335 from the previous week. Newly discharged veterans claiming benefits totaled 4,675, an increase of 344 from the prior week. 2 The highest insured unemployment rates in the week ending March 30 were in New Jersey (2.6), California (2.4), Minnesota (2.4), Rhode Island (2.3), Massachusetts (2.1), Illinois (1.9), New York (1.9), Pennsylvania (1.8), Washington (1.8), and Alaska (1.7). The largest increases in initial claims for the week ending April 6 were in New Jersey (+4,339), New York (+2,499), Pennsylvania (+1,783), Texas (+1,523), and Florida (+977), while the largest decreases were in Iowa (-1,418), California (-631), Ohio (-530), Nevada (-362), and Maryland (-352). 3 4 UNEMPLOYMENT INSURANCE DATA FOR REGULAR STATE PROGRAMS WEEK ENDING April 13 April 6 Change March 30 Prior Year1 Initial Claims (SA) 212,000 212,000 0 222,000 224,000 Initial Claims (NSA) 208,509 215,265 -6,756 197,349 216,740 4-Wk Moving Average (SA) 214,500 214,500 0 214,500 223,000 WEEK ENDING April 6 March 30 Change March 23 Prior Year1 Insured Unemployment (SA) 1,812,000 1,810,000 +2,000 1,789,000 1,737,000 Insured Unemployment (NSA) 1,864,123 1,928,009 -63,886 1,937,973 1,785,781 4-Wk Moving Average (SA) 1,805,250 1,801,000 +4,250 1,799,250 1,708,500 Insured Unemployment Rate (SA)2 1.2% 1.2% 0.0 1.2% 1.2% Insured Unemployment Rate (NSA)2 1.2% 1.3% -0.1 1.3% 1.2% INITIAL CLAIMS FILED IN FEDERAL PROGRAMS (UNADJUSTED) WEEK ENDING April 6 March 30 Change Prior Year1 Federal Employees (UCFE) 327 322 +5 387 Newly Discharged Veterans (UCX) 435 369 +66 320 CONTINUED WEEKS CLAIMED FILED FOR UI BENEFITS IN ALL PROGRAMS (UNADJUSTED) WEEK ENDING March 30 March 23 Change Prior Year1 Regular State 1,923,015 1,932,174 -9,159 1,789,165 Federal Employees 5,546 5,881 -335 5,781 Newly Discharged Veterans 4,675 4,331 +344 4,067 Extended Benefits3 309 276 +33 1,150 State Additional Benefits4 2,612 2,639 -27 1,963 STC / Workshare 5 16,874 20,249 -3,375 19,784 TOTAL 1,953,031 1,965,550 -12,519 1,821,910 FOOTNOTES SA - Seasonally Adjusted Data, NSA - Not Seasonally Adjusted Data Continued weeks claimed represent all weeks of benefits claimed during the week being reported, and do not represent weeks claimed by unique individuals. 1. Prior year is comparable to most recent data. 2. Most recent week used covered employment of 150,520,106 as denominator. 3. Information on the EB program can be found here: EB Program information 4. Some states maintain additional benefit programs for those claimants who exhaust regular benefits, and when applicable, extended benefits. Information on states that participate, and the extent of benefits paid, can be found starting on page 4-5 of this link: Extensions and Special Programs PDF 5. Information on STC/Worksharing can be found starting on page 4-11 of the following link: Extensions and Special Programs PDF 5 Advance State Claims - Not Seasonally Adjusted Initial Claims Filed During Week Ended April 13 Insured Unemployment For Week Ended April 6 STATE Advance Prior Wk Change Advance Prior Wk Change Alabama 2,154 2,007 147 7,480 8,700 -1,220 Alaska 793 622 171 4,849 5,090 -241 Arizona 4,330 4,273 57 21,197 22,070 -873 Arkansas 1,087 1,223 -136 7,450 8,502 -1,052 California 45,469 42,406 3,063 405,683 418,913 -13,230 Colorado 2,847 2,977 -130 27,220 28,295 -1,075 Connecticut 4,589 2,937 1,652 25,928 26,784 -856 Delaware 216 608 -392 5,964 5,440 524 District of Columbia 454 494 -40 5,483 5,490 -7 Florida 5,990 6,385 -395 31,640 34,755 -3,115 Georgia 5,669 4,448 1,221 29,008 29,536 -528 Hawaii 1,102 1,220 -118 6,176 6,473 -297 Idaho 889 1,054 -165 6,899 7,895 -996 Illinois 7,951 9,491 -1,540 114,867 114,835 32 Indiana 3,148 2,643 505 23,235 23,975 -740 Iowa 1,479 1,492 -13 10,008 13,591 -3,583 Kansas 990 1,058 -68 4,818 4,697 121 Kentucky 1,487 2,161 -674 8,191 8,491 -300 Louisiana 1,438 1,683 -245 9,807 10,942 -1,135 Maine 602 532 70 7,685 7,636 49 Maryland 2,290 2,961 -671 23,749 24,502 -753 Massachusetts 4,484 5,030 -546 72,158 75,463 -3,305 Michigan 4,836 5,231 -395 54,460 60,717 -6,257 Minnesota 3,331 4,520 -1,189 61,576 66,713 -5,137 Mississippi 965 956 9 5,146 5,856 -710 Missouri 2,344 2,840 -496 15,855 17,920 -2,065 Montana 556 536 20 6,708 7,879 -1,171 Nebraska 567 606 -39 4,506 5,160 -654 Nevada 2,227 1,852 375 22,542 23,455 -913 New Hampshire 386 404 -18 3,345 3,678 -333 New Jersey 9,405 13,956 -4,551 113,635 108,907 4,728 New Mexico 741 732 9 9,876 9,997 -121 New York 17,184 16,588 596 174,286 174,563 -277 North Carolina 2,834 3,030 -196 18,835 19,891 -1,056 North Dakota 313 293 20 4,015 4,457 -442 Ohio 4,444 5,698 -1,254 46,077 48,216 -2,139 Oklahoma 1,098 1,242 -144 8,944 9,191 -247 Oregon 7,168 5,404 1,764 28,704 28,507 197 Pennsylvania 11,547 13,194 -1,647 98,601 102,747 -4,146 Puerto Rico 1,055 1,180 -125 13,007 14,482 -1,475 Rhode Island 747 616 131 10,111 10,777 -666 South Carolina 2,524 2,591 -67 13,307 13,582 -275 South Dakota 163 194 -31 1,994 2,287 -293 Tennessee 3,603 3,162 441 17,278 17,375 -97 Texas 15,339 15,319 20 132,268 143,261 -10,993 Utah 1,518 1,292 226 11,728 12,577 -849 Vermont 416 423 -7 3,132 2,916 216 Virgin Islands 16 22 -6 258 256 2 Virginia 2,261 2,288 -27 16,376 15,351 1,025 Washington 5,607 5,912 -305 64,552 61,296 3,256 West Virginia 775 735 40 9,632 8,017 1,615 Wisconsin 4,629 6,427 -1,798 31,617 33,753 -2,136 Wyoming 452 317 135 2,257 2,150 107 US Total 208,509 215,265 -6,756 1,864,123 1,928,009 -63,886 Note: Advance claims are not directly comparable to claims reported in prior weeks. Advance claims are reported by the state liable for paying the unemployment compensation, whereas previous weeks reported claims reflect claimants by state of residence. In addition, claims reported as "workshare equivalent" in the previous week are added to the advance claims as a proxy for the current week's "workshare equivalent" activity. 6 Seasonally Adjusted US Weekly UI Claims (in thousands) Week Ending Initial Claims Change from Prior Week 4-Week Average Insured Unemployment Change from Prior Week 4-Week Average IUR April 8, 2023 220 4 224.00 1,737 41 1,708.50 1.2 April 15, 2023 224 4 223.00 1,722 -15 1,714.75 1.2 April 22, 2023 209 -15 217.25 1,705 -17 1,715.00 1.2 April 29, 2023 214 5 216.75 1,706 1 1,717.50 1.2 May 6, 2023 225 11 218.00 1,710 4 1,710.75 1.2 May 13, 2023 225 0 218.25 1,710 0 1,707.75 1.2 May 20, 2023 227 2 222.75 1,729 19 1,713.75 1.2 May 27, 2023 231 4 227.00 1,712 -17 1,715.25 1.2 June 3, 2023 255 24 234.50 1,744 32 1,723.75 1.2 June 10, 2023 260 5 243.25 1,753 9 1,734.50 1.2 June 17, 2023 261 1 251.75 1,750 -3 1,739.75 1.2 June 24, 2023 238 -23 253.50 1,767 17 1,753.50 1.2 July 1, 2023 248 10 251.75 1,770 3 1,760.00 1.2 July 8, 2023 232 -16 244.75 1,786 16 1,768.25 1.2 July 15, 2023 231 -1 237.25 1,765 -21 1,772.00 1.2 July 22, 2023 231 0 235.50 1,776 11 1,774.25 1.2 July 29, 2023 240 9 233.50 1,773 -3 1,775.00 1.2 August 5, 2023 258 18 240.00 1,803 30 1,779.25 1.2 August 12, 2023 248 -10 244.25 1,797 -6 1,787.25 1.2 August 19, 2023 241 -7 246.75 1,819 22 1,798.00 1.2 August 26, 2023 234 -7 245.25 1,802 -17 1,805.25 1.2 September 2, 2023 228 -6 237.75 1,810 8 1,807.00 1.2 September 9, 2023 227 -1 232.50 1,793 -17 1,806.00 1.2 September 16, 2023 210 -17 224.75 1,795 2 1,800.00 1.2 September 23, 2023 213 3 219.50 1,789 -6 1,796.75 1.2 September 30, 2023 216 3 216.50 1,800 11 1,794.25 1.2 October 7, 2023 211 -5 212.50 1,808 8 1,798.00 1.2 October 14, 2023 202 -9 210.50 1,810 2 1,801.75 1.2 October 21, 2023 213 11 210.50 1,816 6 1,808.50 1.2 October 28, 2023 216 3 210.50 1,823 7 1,814.25 1.2 November 4, 2023 216 0 211.75 1,807 -16 1,814.00 1.2 November 11, 2023 228 12 218.25 1,795 -12 1,810.25 1.2 November 18, 2023 213 -15 218.25 1,813 18 1,809.50 1.2 November 25, 2023 213 0 217.50 1,818 5 1,808.25 1.2 December 2, 2023 216 3 217.50 1,818 0 1,811.00 1.2 December 9, 2023 205 -11 211.75 1,803 -15 1,813.00 1.2 December 16, 2023 207 2 210.25 1,817 14 1,814.00 1.2 December 23, 2023 213 6 210.25 1,815 -2 1,813.25 1.2 December 30, 2023 198 -15 205.75 1,759 -56 1,798.50 1.2 January 6, 2024 198 0 204.00 1,728 -31 1,779.75 1.2 January 13, 2024 194 -4 200.75 1,761 33 1,765.75 1.2 January 20, 2024 221 27 202.75 1,829 68 1,769.25 1.2 January 27, 2024 225 4 209.50 1,813 -16 1,782.75 1.2 February 3, 2024 213 -12 213.25 1,803 -10 1,801.50 1.2 February 10, 2024 211 -2 217.50 1,787 -16 1,808.00 1.2 February 17, 2024 200 -11 212.25 1,805 18 1,802.00 1.2 February 24, 2024 213 13 209.25 1,794 -11 1,797.25 1.2 March 2, 2024 210 -3 208.50 1,803 9 1,797.25 1.2 March 9, 2024 212 2 208.75 1,795 -8 1,799.25 1.2 March 16, 2024 212 0 211.75 1,810 15 1,800.50 1.2 March 23, 2024 212 0 211.50 1,789 -21 1,799.25 1.2 March 30, 2024 222 10 214.50 1,810 21 1,801.00 1.2 April 6, 2024 212 -10 214.50 1,812 2 1,805.25 1.2 April 13, 2024 212 0 214.50 7 INITIAL CLAIMS FILED DURING WEEK ENDED APRIL 6 INSURED UNEMPLOYMENT FOR WEEK ENDED MARCH 30 CHANGE FROM CHANGE FROM ALL PROGRAMS EXCLUDING RAILROAD RETIREMENT STATE NAME STATE LAST WEEK YEAR AGO UCFE 1 UCX 1 STATE (%) 2 LAST WEEK YEAR AGO UCFE 1 UCX 1 Alabama 2,007 100 -216 5 5 8,700 0.4 -69 772 32 20 8,752 Alaska 622 -1 -77 4 1 5,090 1.7 -252 -137 56 7 5,153 Arizona 4,273 802 -69 2 2 22,070 0.7 -48 2,039 96 38 22,204 Arkansas 1,223 126 46 0 1 8,502 0.7 -854 1,265 32 10 8,544 California 42,406 -631 -8,184 85 90 418,913 2.4 1,510 1,303 1,035 1,169 421,117 Colorado 2,977 519 487 2 10 28,295 1.0 -139 7,625 155 133 28,583 Connecticut 2,937 798 -862 3 2 26,784 1.6 -3,149 3,408 28 29 26,841 Delaware 608 439 230 1 2 5,440 1.2 -93 1,482 8 34 5,482 District of Columbia 494 37 74 6 3 5,490 1.0 -289 296 140 4 5,634 Florida 6,385 977 107 10 31 34,755 0.4 -1,165 -591 91 115 34,961 Georgia 4,448 936 250 27 15 29,536 0.6 1,361 3,321 204 126 29,866 Hawaii 1,220 155 153 1 8 6,473 1.1 341 773 42 57 6,572 Idaho 1,054 -96 -100 4 0 7,895 1.0 -482 247 67 13 7,975 Illinois 9,491 28 -9 3 2 114,835 1.9 -1,943 12,323 275 121 115,231 Indiana 2,643 -148 -2,167 1 3 23,975 0.8 -13 -2,637 32 35 24,042 Iowa 1,492 -1,418 224 3 2 13,591 0.9 10 1,364 12 4 13,607 Kansas 1,058 -286 121 0 1 4,697 0.3 -249 -88 25 239 4,961 Kentucky 2,161 743 371 3 1 8,491 0.4 -132 188 17 41 8,549 Louisiana 1,683 331 -114 2 3 10,942 0.6 20 -250 32 8 10,982 Maine 532 -100 -215 0 0 7,636 1.2 -192 172 14 8 7,658 Maryland 2,961 -352 410 10 8 24,502 1.0 1,246 4,136 128 86 24,716 Massachusetts 5,030 -188 602 3 10 75,463 2.1 -4,885 -2,697 100 50 75,613 Michigan 5,231 -73 -239 3 4 60,717 1.4 -3,119 -618 83 26 60,826 Minnesota 4,520 808 940 5 5 66,713 2.4 3,166 8,632 65 38 66,816 Mississippi 956 107 -321 0 0 5,856 0.5 -121 631 25 12 5,893 Missouri 2,840 -242 274 6 6 17,920 0.6 -1,377 2,462 67 19 18,006 Montana 536 76 -112 1 0 7,879 1.6 -255 615 191 5 8,075 Nebraska 606 37 -47 1 4 5,160 0.5 -126 1,296 11 5 5,176 Nevada 1,852 -362 -868 2 0 23,455 1.6 -1,060 4,433 59 48 23,562 New Hampshire 404 -8 -1 0 0 3,678 0.5 -88 859 5 1 3,684 New Jersey 13,956 4,339 2,838 20 11 108,907 2.6 -237 12,456 218 164 109,289 New Mexico 732 6 -7 1 4 9,997 1.2 -100 787 95 37 10,129 New York 16,588 2,499 1,795 23 18 174,563 1.9 -2,591 13,201 299 217 175,079 North Carolina 3,030 358 -420 1 2 19,891 0.4 -1 1,228 45 90 20,026 North Dakota 293 48 34 2 2 4,457 1.1 -37 543 6 5 4,468 Ohio 5,698 -530 -4,429 2 8 48,216 0.9 -1,029 -3,638 84 57 48,357 Oklahoma 1,242 92 24 4 9 9,191 0.6 -248 -820 23 33 9,247 Oregon 5,404 857 -669 1 1 28,507 1.5 1,319 -4,094 215 28 28,750 Pennsylvania 13,194 1,783 2,025 12 9 102,747 1.8 400 17,124 215 156 103,118 Puerto Rico 1,180 323 114 3 1 14,482 1.6 355 664 147 56 14,685 Rhode Island 616 -169 -504 2 3 10,777 2.3 -651 1,215 35 25 10,837 South Carolina 2,591 954 400 6 3 13,582 0.6 399 1,384 31 42 13,655 South Dakota 194 18 59 0 0 2,287 0.5 153 67 19 1 2,307 Tennessee 3,162 543 755 2 1 17,375 0.5 22 3,516 39 48 17,462 Texas 15,319 1,523 -2,128 31 106 143,261 1.1 4,118 21,498 403 789 144,453 Utah 1,292 101 -644 5 4 12,577 0.8 -286 998 71 13 12,661 Vermont 423 181 -5 0 0 2,916 1.0 -158 -326 1 1 2,918 Virgin Islands 22 -3 3 0 0 256 0.7 42 52 4 0 260 Virginia 2,288 207 730 5 2 15,351 0.4 49 3,670 79 80 15,510 Washington 5,912 813 -167 5 24 61,296 1.8 -990 8,582 268 301 61,865 West Virginia 735 9 64 0 3 8,017 1.2 -400 819 39 19 8,075 Wisconsin 6,427 846 1,478 6 3 33,753 1.2 2,485 3,697 44 7 33,804 Wyoming 317 4 -151 3 2 2,150 0.8 -132 7 39 5 2,194 Totals 215,265 17,916 -8,117 327 435 1,928,009 1.3 -9,964 135,254 5,546 4,675 1,938,230 Figures appearing in columns showing over-the-week changes reflect all revisions in data for prior week submitted by state agencies. 1. The Unemployment Compensation program for Federal Employees (UCFE) and the Unemployment Compensation for Ex-servicemembers (UCX) exclude claims filed jointly under other programs to avoid duplication. 2. Rate is not seasonally adjusted. The source of U.S. total covered employment is BLS. UNADJUSTED INITIAL CLAIMS FOR WEEK ENDED April 6, 2024 STATES WITH AN INCREASE OF MORE THAN 1,000 State NJ NY PA TX Change +4,339 +2,499 +1,783 +1,523 State Supplied Comment Layoffs in accommodation and food services, in transportation and warehousing, and in public administration industries. Layoffs in transportation and warehousing, in accommodation and food services, and in health care and social assistance industries. Layoffs in construction and in administrative and support and waste management and remediation services industries. No comment. STATES WITH A DECREASE OF MORE THAN 1,000 State IA Change -1,418 State Supplied Comment Fewer layoffs in manufacturing industry. 8 TECHNICAL NOTES This news release presents the weekly unemployment insurance (UI) claims reported by each state's unemployment insurance program offices. These claims may be used for monitoring workload volume, assessing state program operations and for assessing labor market conditions. States initially report claims directly taken by the state liable for the benefit payments, regardless of where the claimant who filed the claim resided. These are the basis for the advance initial claims and continued claims reported each week. These data come from ETA 538, Advance Weekly Initial and Continued Claims Report. The following week initial claims and continued claims are revised based on a second reporting by states that reflect the claimants by state of residence. These data come from the ETA 539, Weekly Claims and Extended Benefits Trigger Data Report. A. Initial Claims An initial claim is a claim filed by an unemployed individual after a separation from an employer. The claimant requests a determination of basic eligibility for the UI program. When an initial claim is filed with a state, certain programmatic activities take place and these result in activity counts including the count of initial claims. The count of U.S. initial claims for unemployment insurance is a leading economic indicator because it is an indication of emerging labor market conditions in the country. However, these are weekly administrative data which are difficult to seasonally adjust, making the series subject to some volatility. B. Continued Weeks Claimed A person who has already filed an initial claim and who has experienced a week of unemployment then files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims are also referred to as insured unemployment, as continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits. The count of U.S. continued weeks claimed is also a good indicator of labor market conditions. While continued claims are not a leading indicator (they roughly coincide with economic cycles at their peaks and lag at cycle troughs), they provide confirming evidence of the direction of the U.S. economy. C. Seasonal Adjustments and Annual Revisions Over the course of a year, the weekly changes in the levels of initial claims and continued claims undergo regularly occurring fluctuations. These fluctuations may result from seasonal changes in weather, major holidays, the opening and closing of schools, or other similar events. Because these seasonal events follow a more or less regular pattern each year, their influence on the level of a series can be tempered by adjusting for regular seasonal variation. These adjustments make trend and cycle developments easier to spot. At the beginning of each calendar year, the Bureau of Labor Statistics provides the Employment and Training Administration (ETA) with a set of seasonal factors to apply to the unadjusted data during that year. Concurrent with the implementation and release of the new seasonal factors, ETA incorporates revisions to the UI claims historical series caused by updates to the unadjusted data. For further questions on the seasonal adjustment methodology, please see the official release page for the UI claims seasonal adjustment factors or contact BLS directly through the Local Area Unemployment Statistics web contact form. Weekly Claims Archives Weekly Claims Data U.S. Department of Labor news materials are accessible at http://www.dol.gov. The Department's Reasonable Accommodation Resource Center converts Departmental information and documents into alternative formats, which include Braille and large print. For alternative format requests, please contact the Department at (202) 693-7828 (voice) or (800) 877-8339 (federal relay). U.S. Department of Labor Employment and Training Administration Washington, D.C. 20210 Release Number: USDL 24-731-NAT Program Contacts: Lawrence Essien: (202) 693-3087 Media Contact: (202) 693-4676

Well, there were a few days there where it looked like everyone would settle down and no one else would get killed.

I guess we were all naive. Israel appears to be striking Iran and at this point, the best we can hope for is that the damage is minimal and casualties are low or zero. And then we go back to hoping that Iran doesn't return fire.

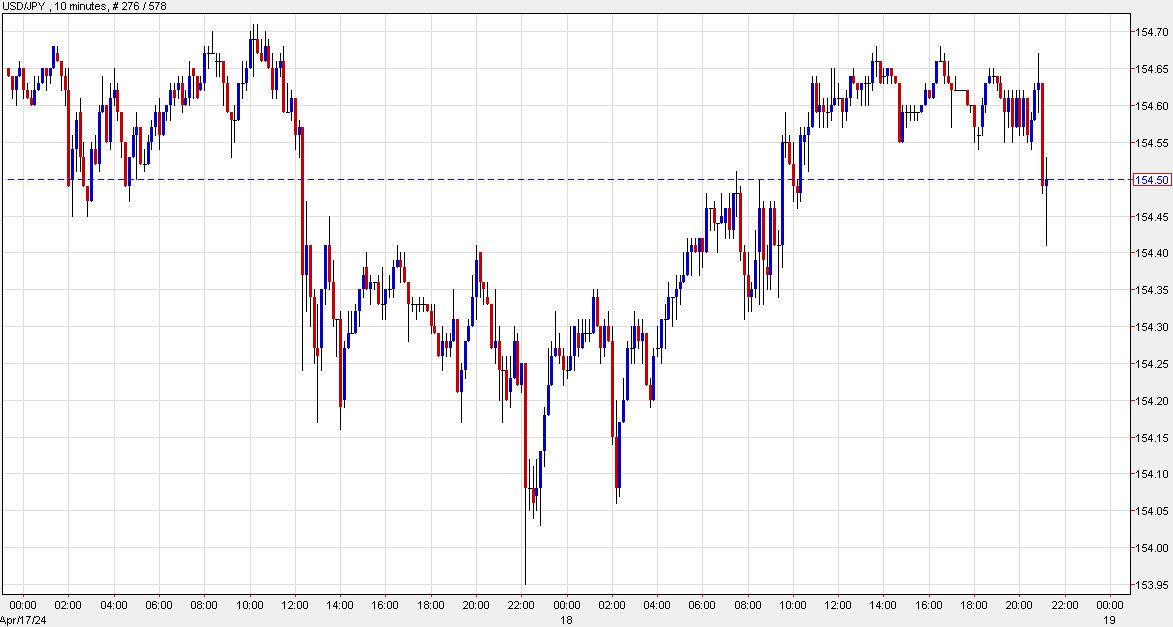

Signs are pointing to the closure of Iranian airspace but so far markets aren't freaking out too much. That could change quickly once we see the size and scope of the response.

WTI crude oil is up 2.4%, trading at $84.60.

Generally the trade here is to fade fear. It's worked so far but it works until it doesn't.